News & videos

The latest car news, videos and expert reviews, from Cars.com's independent automotive journalists

Featured news

What Are the Best 2025 Hybrids for the Money?

With so many hybrid vehicle choices on the market and more coming, these are the best 2025 hybrids for the money.

What’s the Best Compact SUV for 2025?

If you’re shopping for a new car, chances are you’re considering one or more of the seven compact SUVs in this comparison test. See how each SUV did in both subjective and objective categories.

Thinking About Getting an EV Before the Tax Credit Changes?

Read on for guidance about the current state of the electric vehicle tax credit, as well as other advice covering everything about life with EVs.

2025 Cars.com Affordability Report: Best Value New Cars

We’ve compared hundreds of models and thousands of configurations to find the cars that give you the most bang for the buck in popular vehicle classes including SUVs, pickup trucks, EVs, and sedans and hatchbacks.

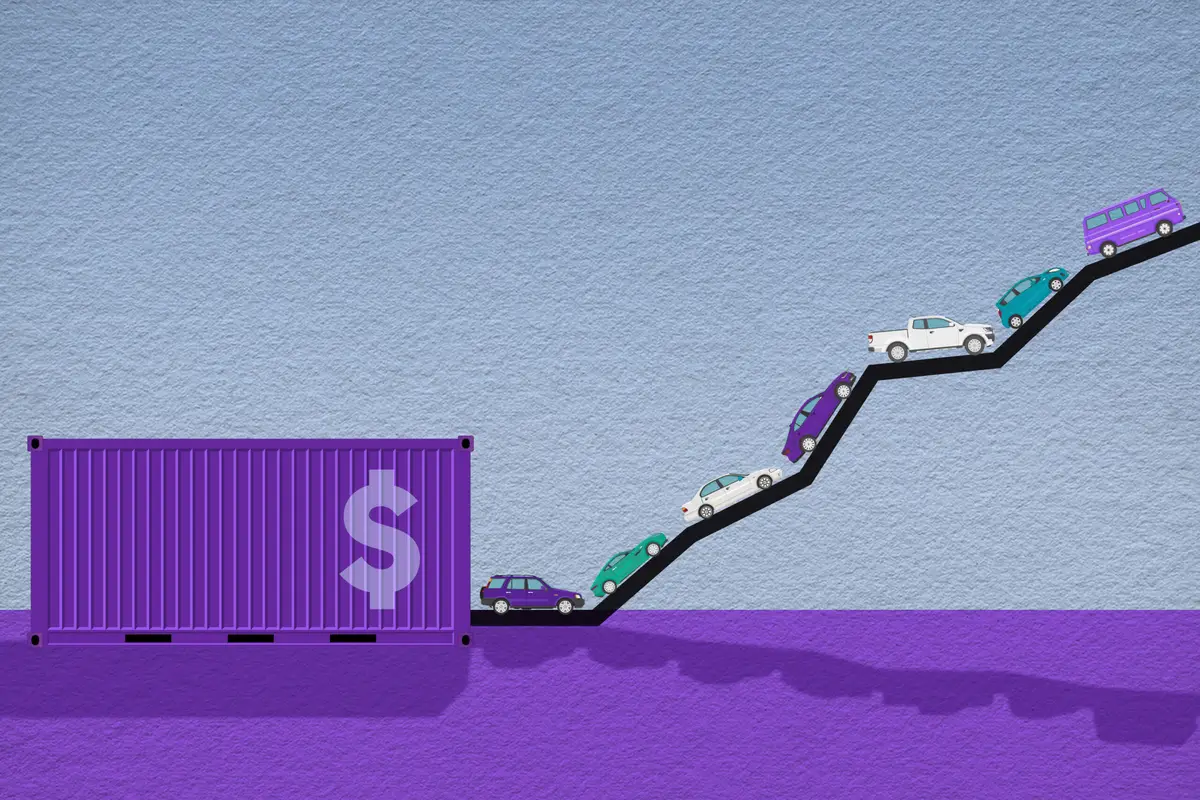

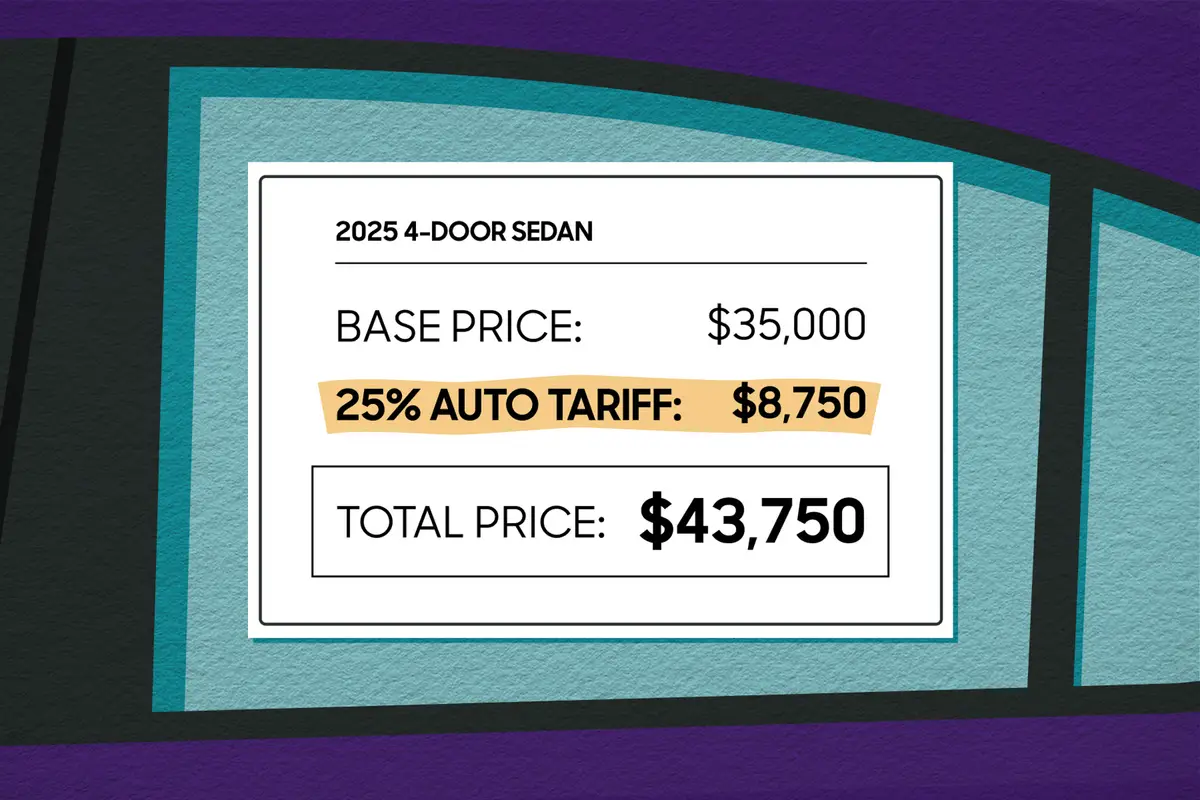

How Trump’s 25% Tariffs on Automobiles, Automotive Parts Will Affect You

The new tariffs went into effect April 3, so here’s everything you need to know about this latest announcement.

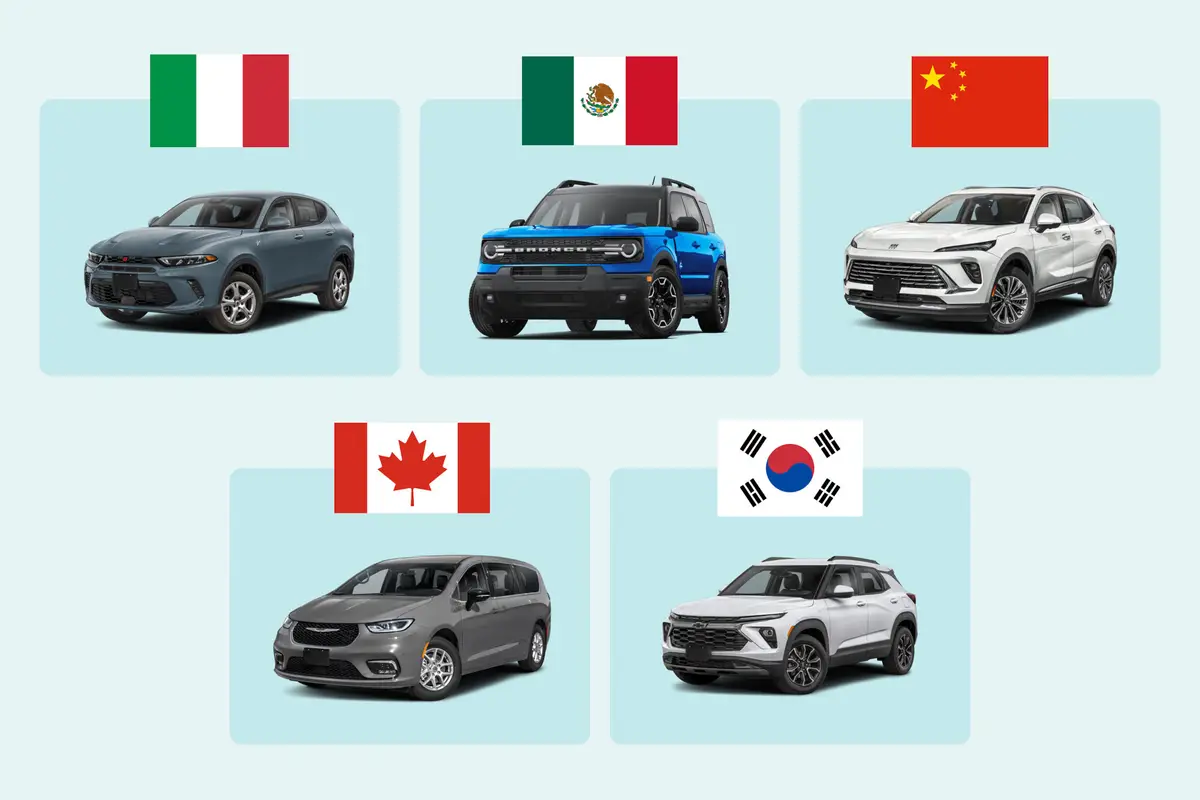

Which Cars Are Made Outside the U.S.?

Cars.com’s breakdown of vehicle assembly locations offers a snapshot of what non-American vehicle manufacturing looks like heading into a new presidency.

Latest videos