Top 10 Best-Selling Cars: July 2012

Automakers had a mixed July as shoppers paid more for their cars. CNW Marketing Research says average transaction prices increased 8.5% versus July 2011 — the third month in a row of year-over-year increases greater than 8%. Compounding all this was the fact that used-car prices declined for the third straight month in July, according to vehicle auction firm Manheim, though they remain higher than at any point before November 2010. Would new-car sales stand a chance?

Well, yes. Sales for the top seven automakers rose 9.3% in July as Toyota and Honda roared back from last year’s earthquake-related shortages — or at least perceived shortages, in Toyota’s case. Honda was the only Japan Three automaker really pinched on inventory a year ago, Automotive News data shows. Either way, both have made a comeback. July sales flew 45.3% at Honda and 26.1% at Toyota, as cars like the outgoing Honda Accord and redesigned Honda Civic trumped onetime top-10 placers the Chevy Malibu and Hyundai Sonata. It’s easy to see why: The Accord has as many incentives as discount-wary Honda would ever unleash, and the Civic’s once-paltry inventory is back to near-industry-average levels.

The Malibu crashed hard — it isn’t even in the top 18 — as inventory dropped to half the industry supply. Spokesman Jim Cain said GM is “almost out of 2012 Malibus,” but Cars.com’s new-car inventory shows otherwise: Some 56% of Malibus are still 2012s.

Chrysler sales gained 12.6%, but Ford and GM fell 3.5% and 6.4%, respectively, to leave the Detroit Three at a slight loss for the month. GM’s losses were the worst of the Big Seven, capping a bad week for an automaker beleaguered by recent high-profile personnel departures.

Why the pain? Ford and GM chalk it up to fleet declines. Ford says overall fleet sales fell 16%, while GM says rental-fleet volume declined 41% as part of a planned drawdown. That could help resale values for both automakers down the road. But other nameplates declined. The Ford Escape fell 11.6% despite a healthy share of redesigned 2013s on dealer lots. The Chevrolet Cruze fared worse, crashing 39.3%. Chevrolet dealers began July with a staggering 90-day Cruze supply — 32 days more than industry average.

Higher incentives brought shoppers to the Ford Fusion, whose sales gained 20.7% for its best July ever. Nissan says the redesigned Altima played a big part in the nameplate’s 24.7% sales gain. Factory incentives — up as much as $1,250 versus a year ago — likely helped clear out the prior generation, which still comprises over half of all Altima sedans in Cars.com’s new-car inventory. Still, the redesign makes up 45.9% of Altima sedan inventory, so it’s clearly gaining steam.

Detroit’s pickups had a mixed month. Ford turned up its F-Series offers, and the best-selling pickup held steady. GM dropped Chevrolet Silverado incentives, and sales fell 12.5%. Chrysler’s Ram pickup gained 17.3% despite slightly lower incentives, and that’s even before the updated 2013 model hits dealerships in early October.

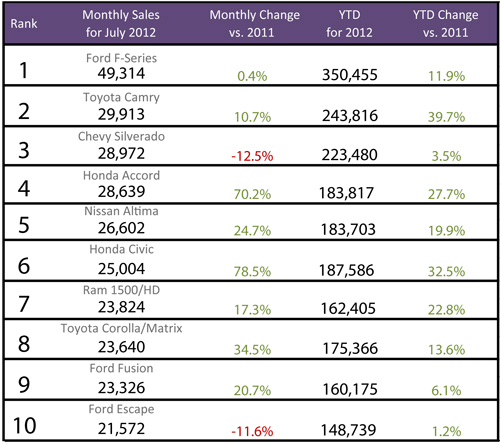

Here are July’s top 10 best-selling cars:

Related

Rebate and Financing Offers in Your Area

June’s Top 10 Best-Selling Cars

More Automotive News

Former Assistant Managing Editor-News Kelsey Mays likes quality, reliability, safety and practicality. But he also likes a fair price.

Featured stories