Auto Loan Basics for First-Time Buyers

CARS.COM — By now, you know what sort of vehicle you want to buy and have a general budget in mind. That’s half the journey when buying for the first time. Unless you have piles of cash, you’ll need to get a loan to buy your first car, and that can be tricky.

Related: More #FirstTimeBuyers Advice

When should you start looking for an auto loan? Are shorter terms or lower interest rates more important? How much should you drop on your down payment? Here’s what you need to know as a first-time buyer.

The basic parts of a typical car loan are:

- The total amount you finance, which equals your car’s negotiated out-the-door price (including any incentives and all taxes and fees) minus your down payment and the value of your trade-in, if you have one

- The interest rate

- The length of the loan

- Your monthly car payment

Know Before You Go

See that ad for zero percent financing? For many consumers, that’s pie in the sky. The Consumer Federation of America estimates that only about 15 percent of car shoppers qualify for zero percent loans. That’s because your credit score — a number between 300 and 850 — has to be pretty high to get it.

It’s easy enough to check your score online, and contrary to popular notion, it doesn’t hurt to check your credit score frequently because those are “considered ‘soft’ inquiries,” said Alexis Jonnson, site director at TheNest.com.

Once you have an idea of your credit history and out-the-door budget, it doesn’t hurt to get preapproved for an auto loan from a bank or credit union. Having pre-set terms can encourage your dealership to make a competitive offer. And if the dealer can’t, you can go with the loan you have lined up.

Loan Lengths Matter

The length of car loans can vary, and a quarter of auto loans were running from 73 to 84 months long, according to Experian, a credit-information provider. Some lenders will make car loans for up to 96 months long. Lengthy terms make for a cheaper monthly payment, but you’ll have to pay the piper elsewhere.

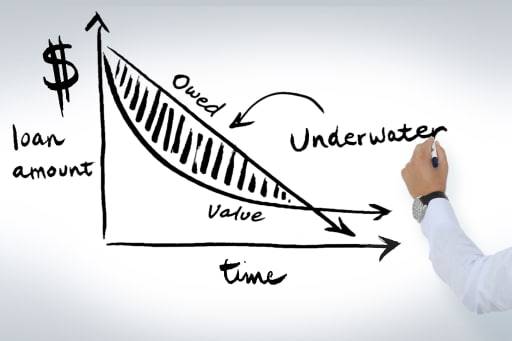

That’s because cars depreciate (meaning, they lose value) the minute you drive them off the lot, and initial depreciation is steep. A typical family sedan is worth between 50 and 65 percent of its original value after two years of ownership, according to residuals calculator ALG, and the bulk of that depreciation comes in the first year. If you haven’t ponied up enough of a down payment that can lead you to being upside-down, or owing more money on a car than it’s worth, for several years into your ownership.

Being in that boat may seem like only a theoretical problem, but it can turn into a real concern:

- Crashes or theft: What happens if your car is stolen or totaled? Insurance typically pays only the value of your car, not the remaining balance on the loan. Many insurers offer what’s called “gap” policies to pay the difference between the value of a car and what you owe on the loan, but that’s more money out of your pocket.

- Mounting costs near the loan’s end: Lengthy car loans often extend beyond your new car’s warranty. That means if the car needs drivetrain repairs after the warranty expires, you’ll have to shell out the cash while you’re still making payments.

- You need a different car: What happens if you add another family member and outgrow your current car? It’s not easy to trade it for a larger car when you’re upside-down on your loan; you’d have to make up the difference between the trade-in value and whatever you owe.

To make sure your car is worth more than you owe on it, commit to shorter loans and higher monthly auto payments. The good news is shorter-term loans often carry lower interest rates. And if you commit more money as a down payment, you’ll maintain positive equity in your car for the entire ownership.

Just how much? Mike Sante, managing editor at Interest.com, advocates at least 20 percent of the vehicle price as your down payment because a car depreciates by about that much the “second you’ve driven off the lot.”

In the market for a “cheap” car? Find cars priced at $6,000 or less near you.

Cars.com’s Editorial department is your source for automotive news and reviews. In line with Cars.com’s long-standing ethics policy, editors and reviewers don’t accept gifts or free trips from automakers. The Editorial department is independent of Cars.com’s advertising, sales and sponsored content departments.

Former Assistant Managing Editor-News Kelsey Mays likes quality, reliability, safety and practicality. But he also likes a fair price.

Featured stories