Can Mahindra Become the Volkswagen of Pickup Trucks?

A year or two ago, the future looked very bright for diesel pickups. Chrysler, Ford, GM and Toyota each announced commitments to produce half-ton trucks with all-new compression-ignition engines by 2010. The news was greeted enthusiastically by truck buyers, who were already familiar with the fuel economy and towing and hauling benefits of diesels, long-offered in the Detroit Three’s heavy-duty pickups.

Nearly lost in the glare of all that diesel star power was an announcement made by Indian automaker Mahindra that it too would sell a midsize oil-burning pickup in the U.S. within two years. Word of Mahindra’s intent was greeted with skepticism, including from this writer. After all, what buyer would gamble hard-earned dollars on a pickup from a country more renowned for Bollywood than for building trucks capable of hauling wood? And how could an Indian-built pickup ever meet the toughest clean-diesel emissions standards in the world?

Now, in what’s shaping up to be one of the most significant pickup truck stories of the past decade, Mahindra has almost completely traded places with Chrysler, Ford, GM and Toyota. The truck giants have indefinitely postponed their small diesels as diesel fuel prices spiked lat year and bankruptcy woes hit Chrysler and GM, while underdog Mahindra has steadily soldiered on with plans to sell its first trucks in America by the end of 2009.

Mahindra’s path hasn’t been without challenges. There have been several miscommunications about the new pickup. The truck had originally been expected to start sales in the first quarter of 2009, before the launch was postponed until December. It was going to be called the Appalachian before that name was scrapped for an alphanumeric badge, likely TR20 or TR40. And a diesel hybrid version has been put on the backburner. But, by and large, it’s been three steps forward for every one step back.

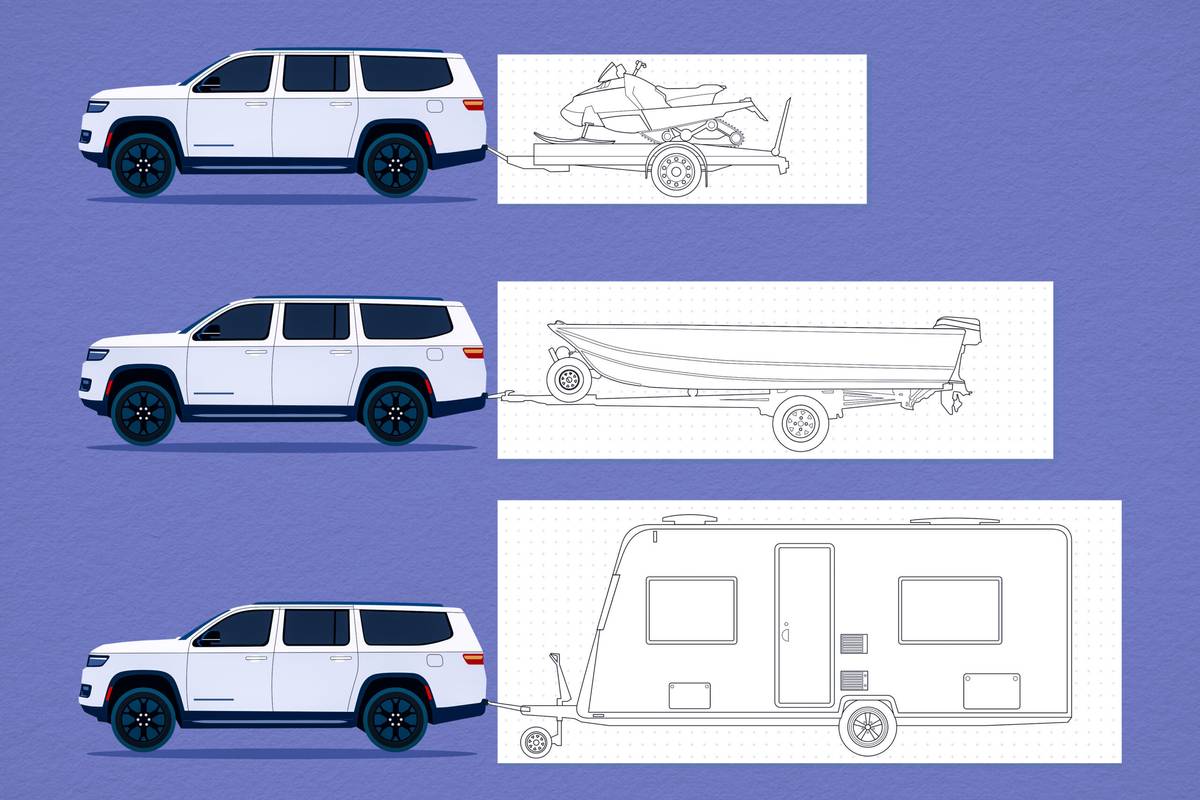

How can this Mumbai-based manufacturer succeed where the most truck-savvy companies have faltered? It appears to be all about price. Mahindra’s U.S. distributor, Global Vehicles U.S.A. Inc., has said it hopes to sell the yet-to-be-named Mahindra pickup starting in the mid- to low-$20,000s. That’s a price many truck buyers will find attractive in return for a high-torque, 2.2-liter four-cylinder engine and six-speed automatic transmission that’s expected to be rated at least 30 mpg on the highway (unloaded) and be able to haul up to 2,700 pounds and tow up to 5,000 pounds.

For comparison, a new base-model, two-wheel-drive, two-door Toyota Tacoma (the best-selling midsize pickup) with a 2.7-liter four-cylinder gas engine and four-speed transmission starts at just over $16,000, but is only rated to carry 1,380 pounds in its cargo box and pull a 3,500-pound trailer. The Tacoma is rated at 19/25 mpg city/highway. So while the difference in price between a comparable gas truck and the Mahindra diesel could be as great at $9,000, I think it will be less than that. That’s also significantly less than the cost of a new entry-level heavy-duty pickup, which can tow much more than the Mahindra but is priced in the low- to mid-$30,000s, with fuel economy in the mid- to upper-teens.

By coincidence, the mid-$20Ks is the price of another long-popular diesel sold in the U.S.: the Volkswagen Jetta TDI passenger sedan. VW crowed about Jetta TDI sales in June, when they accounted for 40 percent of the 8,431 Jettas sold. The TDI starts at $22,270.

Like Mahindra’s pickup, the Jetta TDI’s place in the U.S. market is almost entirely unique and unchallenged. Ford and GM sell midsize diesel sedans in Europe, where they’re very popular, but they don’t sell them in the U.S. for much the same reason light-duty diesel pickups have been shelved: they cost more to produce and domestic manufacturers have been reluctant to believe U.S. buyers will buy diesel cars. The closest competitor to the Jetta is an expensive BMW 335d luxury diesel sedan that has a base price of more than $43,000. Jetta TDI buyers can also opt for lower-priced spark-ignition cars, like a Honda Civic that starts at about $15,000 or a gas Jetta SE that starts at $20,000.

The reason for diesel’s up-front price premium over gas engines is because diesel engines and transmissions have to be built using sturdier parts and construction to handle the higher compression, combustion pressure and torque output versus gasoline powertrains. Also adding cost are specialized emissions components, like diesel particulate filters to trap soot and urea selective catalytic reduction to fight nitric oxide.

Last year, diesel fuel also carried a price premium over regular unleaded gasoline when all fuel prices spiked to over $4 a gallon but in the last month diesel has averaged below gas at the pump, at around $2.60 a gallon. It’s especially meaningful because diesels average 20 to 30 percent better fuel economy over gas vehicles, helping blunt or cancel out the pain of higher purchase costs over a vehicle’s life.

Volkswagen also shares another thing in common with Mahindra: Two of its biggest competitors, Honda and Nissan, announced in 2007 plans to sell reasonably priced clean diesel sedans in the U.S. by 2010, but have since postponed those plans indefinitely leaving the segment entirely to VW.

The biggest advantage Volkswagen has, though, is its built-in base of buyers. VW has sold small and midsize diesel cars in the U.S. since 1977 and has earned an almost cult-like following based on reputation, excellent fuel economy and lack of competition in the segment.

Even though Mahindra is brand new to these shores, I think its starting position is very similar to that of the Jetta. Core truck buyers are already familiar with the benefits of diesel from first- or second-hand experience with heavy-duty pickups, and there’s pent-up demand for a highly fuel-efficient small pickup that can be worked hard even if it can't tow five tons. Buyers are also looking for a relatively low-cost new truck.

Some will argue that Mahindra’s cost advantage comes from being built in India, and to some extent that’s true. But Mahindra is relying on some of the same tier-one suppliers that U.S. truck-makers use — like Bosch to help engineer its high-pressure, common-rail fuel-injection system, AVL for diesel engine architecture (AVL is also helping Ford engineer its “” ethanol-boost engine), and Lear to create an interior that will appeal to American tastes.

If you again look at VW for comparison, its Jetta TDI is engineered in Germany (not exactly known for low-cost labor) and built in Mexico (where heavy-duty Chrysler and light-duty GM pickups are also assembled and Ford’s upcoming “Scorpion” diesel engine will be built), yet ”only” costs $22K.

What I think this demonstrates is that midsize diesel vehicles can still be engineered, built and sold at a reasonable price for the U.S. if the market is already familiar with the benefits of diesel. If Volkswagen can sell 3,300 diesel Jettas in the U.S. in a month while competing against technical marvels like the Toyota Prius, Mahindra should find it has little problem attracting buyers when competing in its own market of one.

Featured stories