Considering Nissan Leaf or Chevy Volt? Leasing May Make More Sense

In the next two months the Nissan Leaf and Chevy Volt will officially go on sale, both with $7,500 in federal tax credits that have been heavily advertised and marketed to potential buyers. However, that $7,500 isn’t going to be easy to come by for all buyers. That’s why leasing one of these two cars may be the more accessible option.

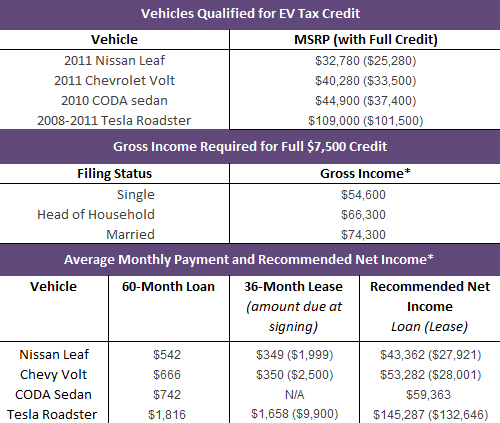

If you’re thinking about buying, here’s what you have to keep in mind: To take the full $7,500 tax credit, you must have a tax liability of at least $7,500. For a single person, the minimum gross income needed to reach the $7,500 liability level is $54,680, according to Bob Meighan, VP of TurboTax, the tax software company owned by Intuit.

While that may sound like a lot, the salary is just about right for Leaf and Volt shoppers, according to Credit.com, which says that an individual shouldn’t spend more than 15% of his or her pay (after payroll deductions) on a car payment.

While the Volt’s $40,280 and Leaf’s $32,780 asking prices are significantly higher than the roughly $28,000 average asking price of today’s new cars, leasing may be one way for folks who make less money to go electric.

The salary needed to lease either vehicle is significantly lower than what’s needed when buying one outright because the tax credit is being taken by the leasing agent, not the consumer. To afford a lease, your take home pay after taxes and deductions would need to be at least $27,921 a year for the Leaf and $28,001 a year for the Volt.

Financing either one with a traditional 60-month loan and the prevailing interest rate puts the Leaf in range of folks taking home at least $43,362. For the Volt, that number is $53,282.

Both Nissan and General Motors acknowledge that their EVs aren’t for everyone and are targeted to wealthier, better-educated car shoppers. More than 30 million households meet the minimum salary requirements to claim the full tax credit, according to the U.S. Census Bureau. That’s a big pool to draw from.

The average Leaf purchaser will be a married, affluent college grad in their mid-40s, according to Nissan. Nissan expects the majority of its Leaf buyers to be eligible for the tax credit.

Let’s assume that every single buyer of these two vehicles meet the salary requirements. The tax credit itself still needs dissecting.

What makes a credit different from the last year’s relatively straightforward Cash for Clunkers rebate program is the EV tax credit reduces your tax liability. In other words, if you owe $8,400 to the IRS at the end of this year’s filing, you can use the $7,500 credit to eliminate all but $900 of what’s owed.

Sounds great, but the catch is you have to have a tax liability equal to or greater than the credit to get the whole $7,500. For instance, if you owe only $6,300 in taxes, your credit is only worth that amount; the other $1,200 is lost forever, according to Intuit. If you have no tax liabilities (say, after claiming your mortgage interest and child tax credits) you would get none of the credit.

With the help of Intuit, we were able to determine that a married couple would have to make at least $74,300 after a standard deduction and have no other tax credits or dependents to earn the full $7,500 tax credit. A single tax filer would have to earn at least $54,600; a head of household would need to top $66,300.

Keep in mind that additional dependents, credits or itemized deductions can rapidly raise the income necessary for the full credit.

The decision to buy or lease is usually dependent on how many miles you travel and how much monthly payment you can afford. With new technology-driven vehicles like the Leaf and Volt, leasing becomes more appealing: There’s less risk in case you don’t want to make sacrifices to go electric.

The Small Print

*Each filing situation assumes that there are no dependents, the “standard deduction” is taken and there are no other credits.

*60-month loan monthly payment includes 15% cash down at 6.23% interest (Bankrate.com’s average national rate, as of Nov. 23, 2010.) Loan rate doesn’t include tax credit or sales tax, title or other fees.

*Lease rate includes tax credit; mileage restrictions apply.

*Payments rounded to nearest dollar.

*Net income represents take-home pay after payroll deductions.

*SSA net compensation estimated from federal income taxes as subject to Form W-2.

Featured stories