Why Used-Car Prices Will Stay High

The dealer offered $2,750.

“I suppose I undervalue my used cars because I drive them for so long,” said Hogan, a 49-year-old who is the director of a domestic violence program in suburban Milwaukee. He handed over the Forester, his wife’s car, last January and bought her a brand-new Kia Soul, a car that starts at $13,900 and is one of the cheapest on the market. It was the first new car Hogan bought in more than a dozen years.

“We are both long-time used-car buyers,” Hogan wrote in an email. “We most often try to purchase low-mileage used cars that are only one or two model years old. … Given the inflated prices at the time, we did not consider seriously any used models.”

Believe it or not, the dealer will likely still make money. Cars.com’s national inventory shows dozens of 1999 Subaru Foresters with more than 100,000 miles, and the median listing price is just shy of $5,000.

Three years of depressed new-car sales have driven used prices to historic highs. Recent evidence suggests possible relief, but it will likely take years, not months, before used-car prices come back down.

Low Sales, Fewer Cars

Such is the result of new-car sales below 16 million, which is what we’ve seen every year since 2008, when the economy crumbled. From 2008 to 2011, recession-wracked car shoppers bought more than 19 million fewer vehicles than during the earlier 2000s. That, in turn, affected the number of used cars on the road today, available to used-car shoppers like Hogan.

New-car sales handily outpaced the number of cars being scrapped by at least 3 million from 2000 to 2007, according to CNW Marketing Research:

*Projected

Sources: Automotive News, CNW Marketing Research, Bloomberg News

The total number of vehicles on the road ballooned over that period. In 2000, the U.S. had some 205 million cars on the road, or 73 cars per 100 Americans, according Polk and census data. By 2007, that number had grown to 241 million cars, or 80 cars for every 100 Americans.

Then came the recession. From 2008 to 2011, Americans bought just 48 million new cars, while junkyards scrapped around 47 million used cars. Predictably, total cars on the road plateaued at around 240 million. The number of Americans driving them continued to grow, however. In 2007 there were 80 cars for every 100 Americans. By 2011, that number had ebbed to 77.

Fewer cars in circulation drove up used-car prices, particularly as drivers hung onto their vehicles longer and longer. A collapse in auto leasing in 2008 exacerbated the situation, leaving the pipeline dry for late-model used cars in 2011 through today — the types of cars Hogan and many others typically zero in on when car shopping.

The result? The average used car went from $9,022 at wholesale in December 2008 to $9,878 three years later, according to Automotive News and ADESA data.

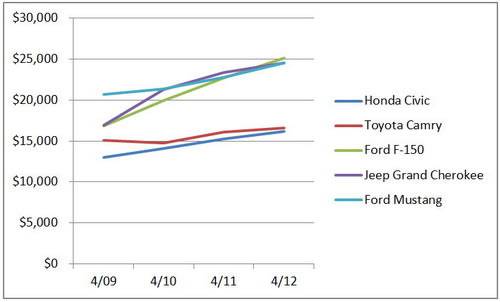

The numbers hit home when you consider Cars.com data for some of the most popular car searches. Look at the Ford F-150, Ford Mustang, Honda Civic, Jeep Grand Cherokee and Toyota Camry. Across the five models, listed prices for used cars 5 years old or newer have increased 29% since April 2009, easily outpacing the relative increase in MSRPs across the same span.

Source: Cars.com data. Each average included used-car listings on 5-year-old and newer cars each April. (For example, April 2009 had 2004-2008 models.)

A Slow Road Back

What needs to happen for the high prices to reverse? Exactly what is happening in 2012 — just more of it over more time. New-car sales are up 10% through the first four months of the year, and analysts surveyed this month by Bloomberg News expect shoppers this year to buy 14.3 million new cars, a 12% gain by year’s end. CNW projects around 12 million cars to be scrapped this year, which signals that the total number of cars on the road will climb once again.

Used-car demand has been falling in the meantime, but could that be due to shoppers making the same choice Hogan did? In 2010, shoppers bought 3.2 used cars for every new car, according to CNW. In 2011, that ratio fell to 3.0. The ratio has seasonal variations, but shoppers through April bought 2.3 used cars for every new car — down from 2.4 cars in the first four months of 2011. Any way you slice it, the relative demand for used cars is falling.

That, combined with a slow but steady influx of used cars, means prices will fall … slowly. Average wholesale used-car prices fell 2% year over year in February, which is the most recent data available from Automotive News. Auto Remarketing, a used-car publication, noted that auto leasing has stabilized — around one in five cars — since early spring 2011.

The relief will be slow. The bulk of 2011’s leases won’t turn over until 2014 and beyond. February’s average wholesale price for a used car is just $31 less than last December’s.

The progress is slow, but it might work out in time for Hogan’s next car. While his wife drives the Soul, he hopes to get a few more years out of his 2005 Toyota Sienna minivan, which he bought in 2007.

“I am hoping to get another three or four years out of our Toyota Sienna,” Hogan wrote. “And I expect, by then, you will be able to get good value in low-mileage used cars again.”

Related

More Automotive Industry News

Research Used Cars

More Automotive News on Cars.com

Former Assistant Managing Editor-News Kelsey Mays likes quality, reliability, safety and practicality. But he also likes a fair price.

Featured stories

2025 Tesla Cybertruck Review: Wedge Issues

2026 Hyundai Palisade Review: Growing Gains