Car Insurers Reportedly Behind on Safety-Tech Discounts

CARS.COM — The latest safety systems may save you from a crash, but they probably won’t save you any money in car insurance. That’s according to a new report from the Associated Press, which found most major auto insurers don’t offer discounts for safety technology such as automatic emergency braking, blind spot warning or lane departure warning systems.

Related: Automakers, Safety Officials Make Crash Avoidance Systems Standard by 2022

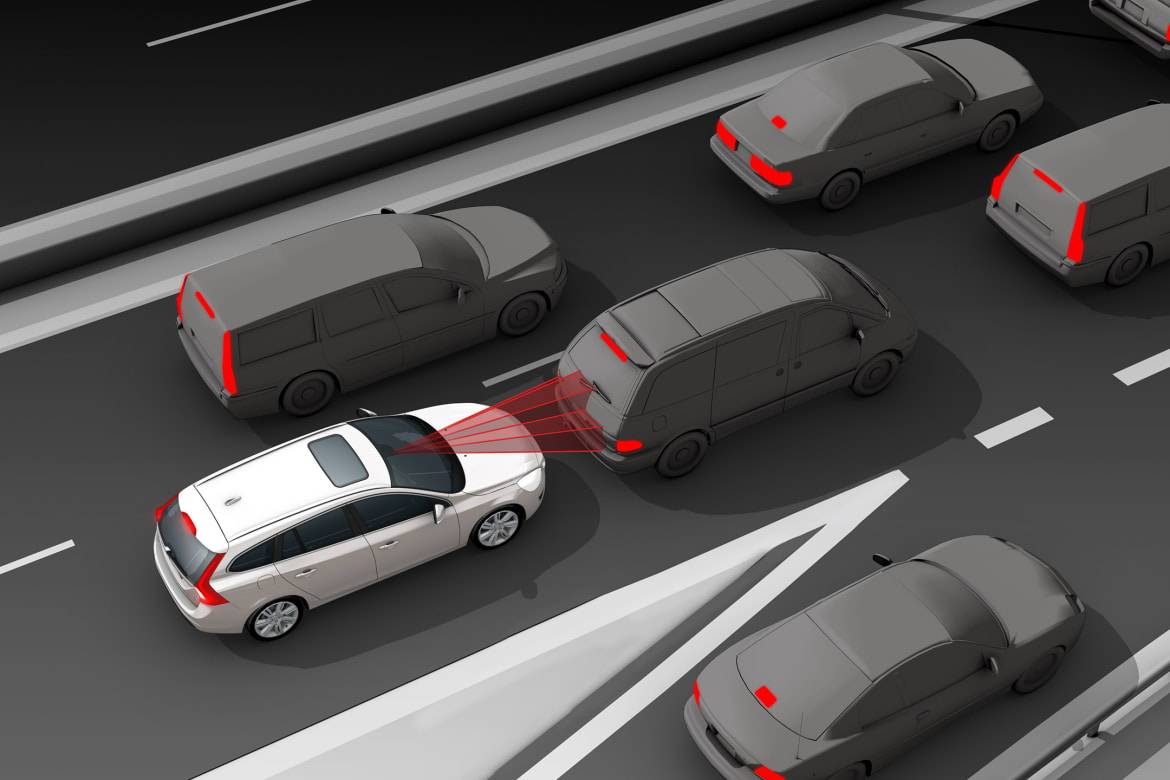

Those features are quickly becoming widespread. The stuff of luxury cars until just a few years ago, collision warning with automatic braking is now available in mass-market vehicles from Hondas to Subarus. It’s effective, too: The Insurance Institute for Highway Safety said in January that forward collision warning with automatic braking reduces rear-end crashes by 39 percent. Virtually the entire auto industry plans to make it standard in new cars by late 2022.

As for lane departure and blind spot warning systems, the research is less clear.

“We have mixed results on whether lane departure warning is reducing crashes, and we have some evidence that drivers may be shutting it off,” IIHS spokesman Russ Rader told Cars.com. “It’s early yet for our research looking at blind-zone detection. There is early indication that it may be effective, but it’s still too [early] — the jury is still out.”

Most car insurance companies reportedly aren’t offering discounts for any of the systems, at least yet. AP surveyed 11 major insurers and found that only two — Hartford Insurance Group and Liberty Mutual Insurance — offer discounts for the technology.

Determining which cars even have it can be a challenge unto itself.

“Insurers don’t have a good way of confirming that a vehicle is equipped with the option because the automakers don’t encode that information in the vehicle identification number like they do other features,” Rader said. “If the automakers decide to add that to the VIN or [when] automatic braking becomes more of a common standard feature, that will change.”

It’s unsurprising that insurers would take a long time to tie discounts to specific safety features. A Bankrate.com study in 2013 found that some insurers still offered discounts for cars with motorized seat belts or frontal airbags — both decades-old features by then — but seldom slashed rates for cars with electronic stability systems, a proven safety feature in line with the times.

Automatic emergency braking could take a while to prompt discounts among mainstream insurers, but it could save you money even if you don’t get a specific discount. Car insurers told AP that vehicles with crash-avoidance systems should have fewer accidents and thus be cheaper to insure on the model level. Over time, the technology could drive indirect savings on your insurance premiums.

For some cars, however, the technology introduces an opposing factor: Crashes may be less frequent, but they could be costlier to repair.

“When automakers put the sensors for front crash prevention systems in the front end behind the grille or the bumper, those sensors — expensive sensors — are vulnerable when crashes happen, and they cost a lot to replace,” Rader said. “Some of the automakers have been responding to that by putting the sensors in the windshield instead of in the grille or the bumper.”

Former Assistant Managing Editor-News Kelsey Mays likes quality, reliability, safety and practicality. But he also likes a fair price.

Featured stories