Inventory Shortage Update: Should You Wait to Buy a Car?

Patience may be a virtue, but it’s likely even the most forbearing car shoppers are fed up with empty dealer lots and stubbornly high prices both for new and used vehicles. We reported in 2021 on the factors responsible for the ongoing inventory shortage, along with advice for prospective car buyers. As the vehicle shortage drags on, we’re updating you on the current status of the market and addressing the pressing questions:

- When will inventory stabilize and car prices drop?

- Should you wait to buy a car?

- What can you do if putting off a car purchase isn’t feasible?

Related: Inventory Pinch: New Models You Might Find — at a Price

Although we ain’t got no crystal ball to see exactly when this erratic market will turn a corner, a look at the current conditions and expert forecasts help to shed some light on whether shoppers should brave the storm or wait it out until conditions improve.

What’s the Status Today?

According to a December 2021 report from analytics firm IHS Markit, U.S. inventory levels are at their lowest levels since the global financial crisis of the late 2000s, but the needle is moving in the right direction for vehicle production. Although the microchip shortage continues to be a significant disruptor, automakers are learning to adapt to the tight supply to keep production lines moving. Sooner-than-anticipated restoration of semiconductor manufacturing in Asia may ease the chip shortage to some degree in 2022. (You can think of semiconductors and microchips interchangeably, though the former has a simpler core meaning.)

Sam Fiorani, vice president of global vehicle forecasting at AutoForecastSolutions, agrees that automakers are starting to regain their footing, but he notes that shoppers shouldn’t expect to reap the benefits instantly.

“Recent announcements from Ford and GM, among other manufacturers, provide hope that the semiconductor shortage will become less of a limiting factor for vehicle production,” Fiorani said. “While this is not necessarily going to open the floodgates of vehicle output, it will, if all goes as planned, allow growth in the industry in the new year compared to 2021.”

Inventory Shortage Continues Into 2022

According to Tyson Jominy, J.D. Power’s vice president of data and analytics, vehicle inventory is still at rock-bottom levels despite the recent production recoveries.

“Inventory ended November near all-time record lows, right [at] about 850,000 units on the ground or soon to be arriving at dealerships,” Jominy said. “In 2018 [by contrast], the industry retailed just shy of 1.4 million new vehicles in December, so we are starting with inventory at 60% of the typical sales pace, or with just over two weeks of supply on the ground.”

Even Sedans Are Hard to Find

At the start of the inventory crisis, shoppers in the market for a sedan had an edge over those hunting for SUVs or pickup trucks. But now, even sedans are scarce.

“Sedans had a relative inventory advantage at the start of summer because consumers were still gravitating toward trucks and SUVs first,” Jominy said. “However, automakers have now been prioritizing production to higher-profit-margin trucks and SUVs, so that there are very few sedans produced to backfill those that were finally sold. In short, there are very few sedans on the ground anymore even as truck and SUV inventory has nudged up slightly.”

Just How Much Has Inventory Sunk?

Automotive News’ inventory breakdown by manufacturer paints a stark contrast between a pre-pandemic 2019 and current conditions.

- As of Dec. 1, 2021, Honda inventory stood at 59,800 vehicles, down 83% from the 346,100 units the automaker had at the same time in 2019. The brand’s days’ supply — the number of days at the current sales rate needed to sell all vehicles in its pipeline — was just 19 days in November 2021, compared with 75 in 2019.

- Toyota’s inventory followed a similar pattern, falling 75% between December 2019 and 2021. Toyota’s days to sell dropped to 17 from a pre-pandemic 59.

- Ford’s inventory also plummeted, though to a lesser extent than the Japanese automakers mentioned above. The Blue Oval’s supply of vehicles fell 66%, with 214,800 units as of Dec. 1. That’s compared to 633,000 units two years prior. Ford had 34 days’ supply of vehicles in November 2021 versus 93 in late 2019.

New-Car Shoppers: Expect to Pay Sticker

As vehicle demand continues to outpace inventory, the average new-vehicle transaction price is maintaining its upward trajectory. According to J.D. Power’s monthly automotive forecast, the average transaction price was estimated at a record $44,043 for November — an 18% increase from November 2020. For new-car shoppers, part of the affordability crisis involves scant manufacturer incentives that are partially to blame. The average incentive hit a record low of $1,612 in November, or just 3.6% of MSRP. Compare that with pre-pandemic times, when new-car incentives were often 10% of MSRP or more.

Not only are some car shoppers settling for the smaller incentives, according to Jominy, but many are biting the bullet and paying sticker price (or above) for their vehicles.

In fact, some 9 in every 10 vehicles “have a negotiated price near or above MSRP,” Jominy said. “The amount tends to increase the higher the MSRP, too, as the wealthiest consumers have experienced greater purchasing power from lack of entertainment and vacation options, to run-ups in home values and financial portfolios. It is not uncommon to see significant markups on any hot vehicle such as [a] Kia Telluride and Ford Bronco.”

Used-Car Prices Continue Their Upswing

A used-car shortage that swiftly followed the delays in new-car production, meanwhile, has catapulted the market value on pre-owned cars. The domino effect was so dramatic that the price of some used cars approached their new counterparts. The median listing price among Cars.com dealers for all used cars in December 2021 was $25,242, up from $17,493 in pre-pandemic December 2019 (a 44% increase). Some signs emerged that used cars might be reaching a price plateau in the fall of 2021, but that doesn’t seem to have happened. Prices didn’t stabilize; instead, they continued their upward trend, increasing every month since August — including a 2.2% month-over-month increase in November, the steepest gain since midyear.

When Will the Inventory Shortage Improve?

IHS Markit automotive analysts are cautiously optimistic that 2021 saw the worst of the inventory crisis, but chip shortages and other supply-chain disruptions are expected to continue — to a lesser degree — until 2023.

“For 2022, the pace of sales is expected to quicken in the second half of the year,” said Chris Hopson, a forecast manager at IHS Markit. “Given current inventory conditions, it’s difficult to project significant demand recovery in the first half of 2022. But we expect to exit 2022 with a pace of sales more recognizable to pre-COVID levels, setting the stage for better volume outlooks into 2023 and 2024.”

Despite the positive outlook for vehicle production and chip availability in 2022, IHS Markit says that looming threats could prolong the crisis — namely, workforce availability and the supply of raw materials (for example, China’s magnesium shortage).

Jominy thinks vehicle production will likely improve in 2022, but some lag may come before it benefits shoppers.

“Many of the current market dynamics will be present throughout 2022, including very sparse inventory at dealer lots and high prices,” he said. “The good news is that production is expected to increase, which will make it easier to get a vehicle, but do not expect dealer lots to fill up. The industry lost 2.5 million sales in 2020 and another 2 million in 2021, so there are a lot of people waiting for a car. As the industry works through pent-up demand, it will be likely to see a ‘one-in, one-out’ system where vehicles are delivered [to customers] as soon as they arrive at dealerships. Most sales will be preordered or spoken for long before they arrive at dealerships.”

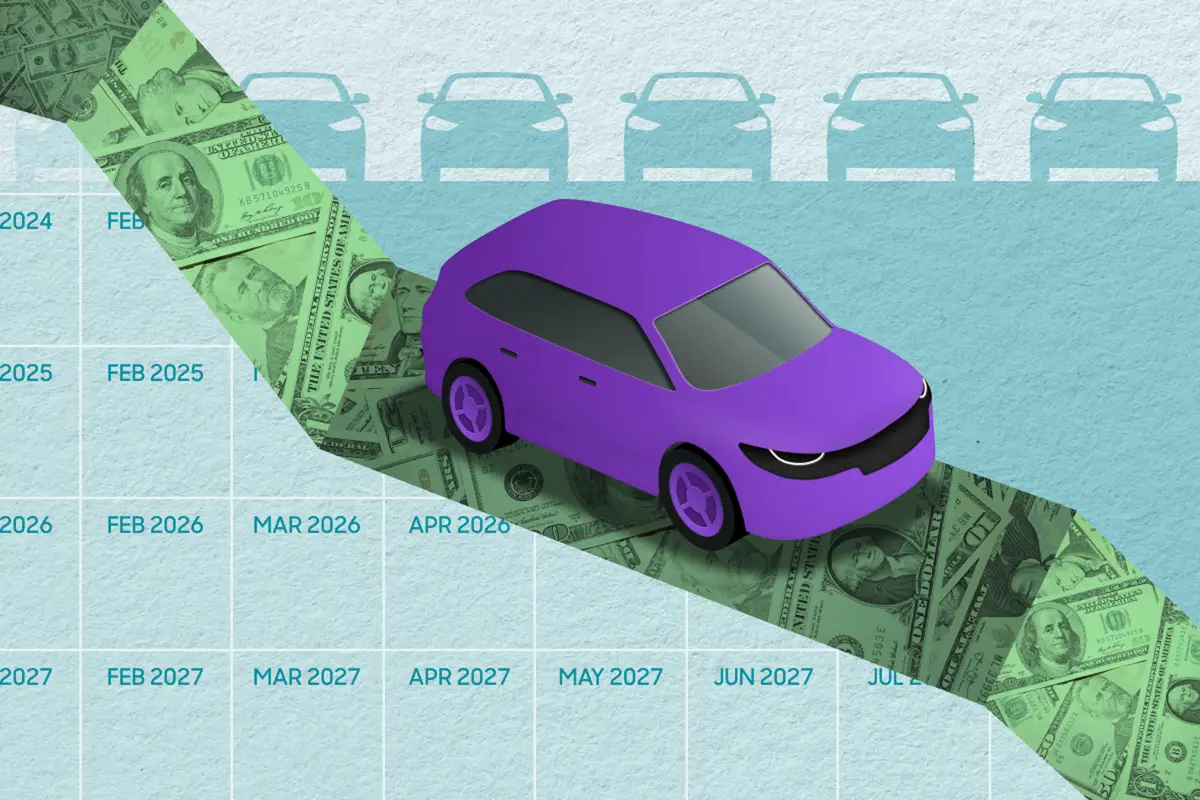

When Will Used-Car Prices Drop?

A dip in used-car prices might arrive ahead of the market stabilizing in late 2022, says Automotive News, citing a forecast from consulting firm KPMG. Once that happens, used-vehicle prices could drop 20%-30% prior to supply and demand reaching a balance between October 2022 and 2023, the report says. Fiorani estimates a similar time frame: “Full stabilization in the industry is still six to 12 months away,” he said.

The predicted plunge could bring relief to used-car shoppers who choose to wait it out, but it spells trouble for those who financed a used vehicle at an elevated price and find themselves underwater if they need to trade it in.

Inventory and Price: What Is the ‘New Normal’?

What will the market look like once the inventory shortage ends? According to Fiorani, shoppers could see less inventory and fewer incentives in the future compared to pre-pandemic times, but the difference won’t be as drastic as the current conditions.

“Dealers and vehicle manufacturers have learned that they can make money on lower inventory levels,” Fiorani said. “On the surface, this looks like the ‘new normal’ will include leaner dealer inventories going forward.”

But something closer to a buyer-friendly market should return eventually.

“Manufacturers will continue to push more volume and dealers will need to generate more sales,” Fiorani continued. “Competition will return the industry to something closer to where it had been and away from the extremely lean inventories from this past fall. Generations of paying ‘less than the sticker’ will not be forgotten overnight.”

When it comes to future vehicle inventory, IHS Markit also predicts a more balanced scenario where days to sell will fall somewhere between pre-pandemic levels that ranged from 70-80 days and the current sub-20 day levels. For popular segments like pickup trucks, IHS Markit estimated days to sell will be around 40-50.

More From Cars.com:

Should You Wait to Buy a Car?

If putting off a car purchase for a year or two is a viable option, it could be best to do so. The benefits may include an expanded pool of vehicles to choose from, plus a gradual drop in prices as the market moves toward some semblance of normal.

“Patience remains the best advice,” Fiorani said. “If you have an extra vehicle, take advantage of the current shortage of used vehicles and get as much as a dealer or another buyer will pay while you can. If you do not need to replace your current vehicle immediately, don’t. Prices should come down as inventories rise throughout 2022.”

Normal, or at least closer to normal, times should return.

“Even if vehicle manufacturers and dealers continue on the current path of low inventory, only a limited number of buyers can afford the premium on new vehicles,” Fiorani added. “The industry has relied on selling 16-17 million vehicles per year for so long that lower sales would cause a large reorganization of their entire business.”

There’s one exception: Consumers who are coming up on the end of their car leases. These shoppers can take advantage of rising used-car values by buying their leased vehicle.

“Returning lessees are finding that the best deal in the market can be found in buying out their existing leases at a residual value set three years ago,” Jominy said. “Some consumers can use this equity toward another vehicle to sell to an external third party like Carvana or to stay out of the new market.”

What if I Can’t Wait?

Shoppers who can’t put off buying a car for one or two years should remain flexible and be prepared to purchase as soon as the right vehicle becomes available. While traditional haggling is unlikely to yield substantial savings, other strategies — like shopping around for financing and negotiating on the trade-in — can help alleviate some of the sticker shock. According to J.D. Power, that trade-in amount can be substantial: The firm pegged average trade-in values for December at $10,199, up $4,623 or 83% from a year ago. It’s the first time average trade-in values have surpassed $10,000.

Cars.com’s Editorial department is your source for automotive news and reviews. In line with Cars.com’s long-standing ethics policy, editors and reviewers don’t accept gifts or free trips from automakers. The Editorial department is independent of Cars.com’s advertising, sales and sponsored content departments.

Former News Editor Jane Ulitskaya joined the Cars.com team in 2021, and her areas of focus included researching and reporting on vehicle pricing, inventory and auto finance trends.

Featured stories

15-Year Car Loans Aren’t a Thing, But Americans Are Getting More Comfortable With Long Loan Terms

2025 Kia Telluride Review: Rougher Roads Ahead