How Trump’s 25% Tariffs on Automobiles, Automotive Parts Will Affect You

Editor’s note: This story was updated April 29, 2025, to include additional tariff updates.

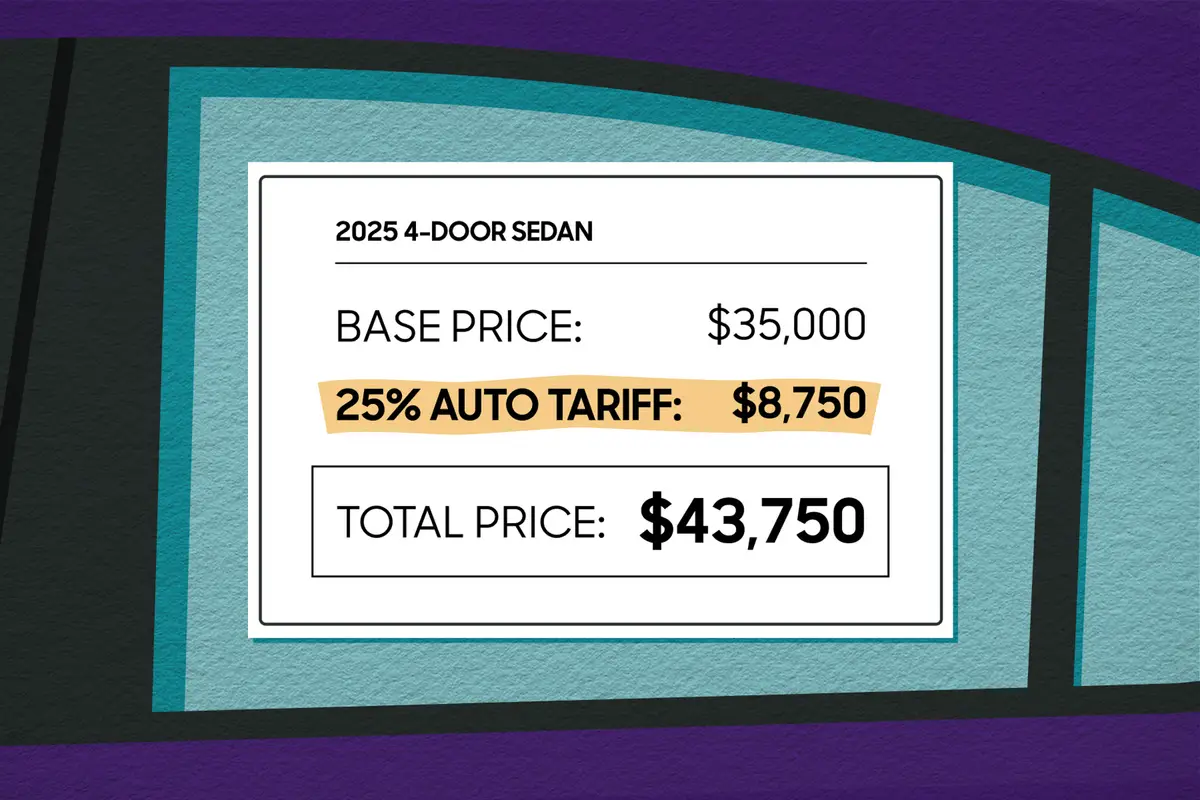

On March 26, President Donald Trump announced sweeping new 25% tariffs on imported vehicles and vehicle parts that could affect everything from the price of your next car to the costs of maintaining your existing car. Consumers rarely pay tariffs directly, as tariffs are taxes paid on imported goods by the companies that import them. However, because these tariffs increase the price of producing those goods on the company’s end, that additional cost is frequently passed on to consumers. The new tariff on automobiles went into effect April 3, and the tariff on automotive parts will be finalized by May. Here’s everything you need to know about them.

Related: More Tariff-Related News

How Will Trump’s Auto Tariffs Work?

Both vehicles assembled outside of the U.S. as well as individual automotive components imported into the U.S. will be subject to the new tariff. While tariffs on automobiles are already in effect, tariffs on parts will be enacted “no later than May 3, 2025,” per the executive order. The components affected by the new tariffs include “key automobile parts (engines, transmissions, powertrain parts and electrical components), with processes to expand tariffs on additional parts if necessary.” No further specifics on parts tariffs have been released at this time, as the Trump administration is still finalizing how to implement them. A proclamation finalizing the new tariffs’ structure confirmed that the tariffs are added onto existing tariffs, including the 2.5% import tariff on vehicles that’s already in place, plus the longstanding 25% tariff on light trucks known as the “chicken tax.”

A significant exception to these tariffs is for automotive vehicles and parts that are imported under the existing United States-Mexico-Canada Agreement. This is a trade agreement with our two neighboring countries negotiated under the previous Trump administration that included a provision to import passenger vehicles and light trucks into the U.S. tariff-free so long as they meet certain criteria for using North American labor and percentages of content from North America.

Under the new automotive tariff scheme, companies will be able to certify the amount of U.S. content in these currently duty-free vehicles such that the tariff will only apply to the value of the non-U.S. content in those cars. Likewise, imported parts that comply with the USMCA will stay tariff-free until the Secretary of Commerce and U.S. Customs and Border Protection can determine a process to tariff the non-U.S. content. Automotive imports that aren’t compliant with the USMCA will not get this exception from the 25% tariff, however.

Automobiles and automotive parts are also exempt from Trump’s new “reciprocal tariffs” on all imported goods that go into effect on April 9. You can read more about those here, and while they have the potential to increase operational costs for auto companies — think things like office supplies becoming more expensive — these country-specific tariffs of 10% and more will not apply directly to finished vehicles and car parts.

Further exemptions and offsets were added through a pair of executive orders signed April 29. Trump exempted automobiles and automotive parts subject to these 25% tariffs from being subject to the additional 25% tariff on their steel and aluminum content, as well as the extra 25% tariff on non-USMCA-compliant Canadian and Mexican goods. Additionally, for U.S.-assembled cars, automakers can apply for import adjustment offsets for imported foreign parts of up to 3.75% of a car’s final MSRP for the next year, with a drop to 2.5% in May 2026 and phased out entirely in May 2027.

The Trump administration justified its additional automotive tariffs as necessary to protect national security. It also noted that international supply chain interruptions during the pandemic affected domestic auto manufacturers’ ability to keep producing new vehicles and keep American auto industry workers employed.

The goal is to encourage automotive companies to manufacture more cars in the U.S. so they can avoid these tariffs, but as we’ve noted in our previous explainers of how tariffs work, it isn’t that simple. The automotive industry is a highly international one where a single part can cross the border multiple times before ending up in a finished vehicle. Shifting supply chains and setting up new manufacturing facilities can take years, leaving companies with additional costs to bear in the interim. Because companies still need to turn a profit in order to survive, those extra costs often get passed along to consumers.

How Will Trump’s Tariffs Affect Car Prices?

If there’s one thing we’ve learned from compiling the American-Made Index — wherein we analyze how much of each model on sale is actually made in the U.S. — it’s that every car for sale in the domestic market uses at least some foreign-made parts. According to Department of Transportation data, every model-year 2025 vehicle had at least 20% of its content come from outside the U.S. and Canada. The two countries’ auto manufacturing sectors are so intertwined that even the DOT hasn’t historically separated the two due to how difficult it is.

According to American Automobile Labeling Act data, the Kia EV6 contains the most U.S. and Canadian parts content out of all 2025 models at 80%, leaving one-fifth of its price tag vulnerable to tariffs. Even last year’s “most American” model in our American-Made Index, the Tesla Model Y, gathers 30% of its content from outside the U.S. and Canada for 2025. Other models are far more exposed to increased import prices, including many reasonably priced cars as well as vehicles from American-based automakers alongside the foreign marques you’d likely expect. We’ve rounded up the long list of models assembled outside the U.S. here, but 2025 models that include zero U.S. and Canadian content per AALA data include the Hyundai Elantra, Kia K5, Mazda MX-5 Miata, Mitsubishi Eclipse Cross and Toyota Prius. Foreign-built U.S.-marque cars can have as little as 2% U.S. and Canadian content, as is the case with the Buick Encore GX and Chevy Trax.

The aforementioned 25% chicken tax — a retaliatory tariff instated in 1964 — is a bleak preview of what could happen if these new auto tariffs remain in effect for the long haul, as the chicken tax has directly resulted in fewer foreign-made commercial vehicles and light trucks making their way stateside. Full-size trucks are among the most popular vehicles in the U.S., but compact and mid-size trucks have been relatively few and far between unless they were built in North America, as they simply weren’t profitable to import here. The few foreign-built light trucks that come over here, such as the Ineos Grenadier Quartermaster, tend to be more expensive as a direct result of this stiff tariff.

As for the new tariffs, cars assembled in the U.S. with a higher percentage of American-made content are the least exposed to these extra import costs, but all of this is bad news at a time when the average new-car price on Cars.com was $48,720 in February and interest rates to finance those cars remain high. The new tariffs could increase new-car prices anywhere from $2,500 to over $20,000, according to an Anderson Economic Group analysis that factored in all of the tariffs announced April 2. Meanwhile, higher new-car prices frequently push buyers to the used market, which is still reeling from curtailed production during the pandemic that translated to fewer late-model, lower-mileage cars for sale today.

The short-term effects of new tariffs going into effect could also cause a shortage of desirable cars for sale. Anytime a new tariff or process is introduced at the border, it’s a disruption that can cause gridlock and, ultimately, reduced production of cars. As we saw during the pandemic, fewer cars for sale can translate to higher prices for consumers, as supply can’t keep up with demand. According to one analysis by S&P Global Mobility, such an industry disruption could last four weeks or longer just from the introduction of steep tariffs on Mexico and Canada, much less from a new tariff on all automotive imports.

The lower end of the market is particularly vulnerable to new tariffs, as reasonably priced cars are frequently assembled in countries with lower labor costs in order to make them financially viable to sell. As another S&P Global Mobility analysis stated, a 25% duty on a car worth $25,000 would add $6,250 to the cost.

“Importers are likely to pass most, if not all, of this increase to consumers,” the analysis noted.

The options for automakers selling these lower-margin cars are bleak. If they’re no longer profitable to sell at their current price, auto companies could pull them from the market altogether, leaving consumers with fewer choices.

How Will New Tariffs Affect Cars You Already Own?

New-car prices aren’t the only things affected by this announcement, as older cars may also feel the pain of tariffs on automotive components. Depending on which components are ultimately tariffed and how, increased costs on automotive parts will translate to increased costs for repairs on existing vehicles.

Even if you don’t need to swap out a major component like a Canadian-assembled transmission anytime soon, you could still feel the effects of higher parts prices through higher insurance rates. Automotive insurance companies have to offset higher repair costs somewhere, and that typically results in charging consumers higher rates for coverage.

Is Any Relief Coming for Consumers?

Trump has stated several times that he wants to make interest paid on automotive loans for U.S.-made cars deductible from income taxes. Unless other tax reforms are instated, however, this may only provide relief for higher-income taxpayers, as most low- and middle-income households take the standard deduction instead of itemizing out individual tax deductions.

What Happens From Here?

Given all of the back-and-forth over tariffs we’ve seen since Trump took office in January, you may be wondering if this is yet another example of the boy who cried tariff. Trump’s previous tariff announcements have been met with swift retaliatory measures from countries who don’t like the idea of new tariffs hindering their access to the lucrative U.S. market, and these new tariffs are no exception.

On April 3, Canadian Prime Minister Mark Carney announced a new 25% tariff on automobiles imported from the U.S. Canada declined to match the U.S.’s planned tariff on auto parts, however, as Carney explained that his country realizes that its auto trade is highly integrated with the U.S. in a way that’s benefitted Canada. Putting tariffs on parts that go back and forth across the border multiple times would end up hurting Canadian businesses.

Likewise, following the announcement of the automotive tariffs in March, European Commission President Ursula von der Leyen said the European Union will “seek negotiated solutions, while safeguarding its economic interests,” per The Wall Street Journal. However, von der Leyen announced on April 3 that the bloc is finalizing a package of up to $28.4 billion of tariffs on U.S. imports into the EU that will be introduced in mid-April. While these are meant to retaliate against a different set of steel and aluminum tariffs that went into effect on March 12, von der Leyen said the EU was “now preparing for further countermeasures to protect our interests and our businesses if negotiations fail,” likely in response to additional tariffs announced by the U.S.

Shortly after the automotive tariffs were announced in March, Trump threatened in a Truth Social post to retaliate further against any retaliatory measures against these new auto tariffs put in place by the EU and Canada. However, even more trading partners have since threatened to instate retaliatory measures against the U.S. following the announcement of reciprocal tariffs that go into effect April 9.

As mentioned earlier, the increased costs of moving cars and parts across borders is bad news for the extremely globalized automotive industry — and for consumers looking to purchase or maintain cars. If you work in the auto industry, there’s extra cause for concern: If American vehicles and auto parts are more expensive abroad, it could hurt American companies’ sales — and consequently, American jobs.

However, threats of retaliatory measures and industry pushback have been somewhat effective so far in getting the Trump administration to call off or delay its tariff plans. For example, planned tariffs on most Canadian and Mexican goods went on hold until April 2 after pushback from both affected countries as well as the automotive industry, and extra tariffs on steel and aluminum were abandoned after Ontario announced a 25% tax on electricity exports to the U.S. So, there is always the chance that negotiations or threats could change whether these tariffs remain in place. We’ll have to wait and see how things shake out.

More From Cars.com:

- Which Tariffs Could Affect Your Next Car?

- Tariffs on Mexican, Canadian and Chinese Goods Could Affect These Cars the Most

- 2024 Cars.com American-Made Index: Which Cars Are the Most American?

- How Are Automakers Responding to Trump’s Tariffs?

- Find Your Next Car

What Can Consumers Do?

Our guidance remains the same as when previous tariffs have been announced: If you’re shopping for a car, act sooner rather than later. You’ll still need to consider the total price of the vehicle, including interest rates, tax credits, promotional offers and the costs of maintenance and fuel. Electric vehicles in particular are likely the most reasonable they’ll be for the foreseeable future. Despite Trump’s open dislike of EV incentives, tax credits applicable toward EV purchases are still available at the moment, so take advantage of them if you can.

Alternatively, if you can’t manage a new-car purchase right now, you may want to simply ride out any tariff instability by keeping your existing car. In that case, we recommend taking care of preventative maintenance as soon as you can. If you need foreign-made automotive parts to fix your existing vehicle, consider picking them up now even if you need to wait to get that work done. With parts tariffs not going into effect until May, you have some extra time to gather what you need before those tariffs affect pricing.

Related Video:

Cars.com’s Editorial department is your source for automotive news and reviews. In line with Cars.com’s long-standing ethics policy, editors and reviewers don’t accept gifts or free trips from automakers. The Editorial department is independent of Cars.com’s advertising, sales and sponsored content departments.

News Editor Stef Schrader joined Cars.com in 2024 but began her career in automotive journalism in 2013. She currently has a Porsche 944 and Volkswagen 411 that are racecars and a Mitsubishi Lancer GTS that isn’t a racecar (but sometimes goes on track anyway). Ask her about Fisher-Price Puffalumps.

Featured stories