Do I Need Gap Insurance?

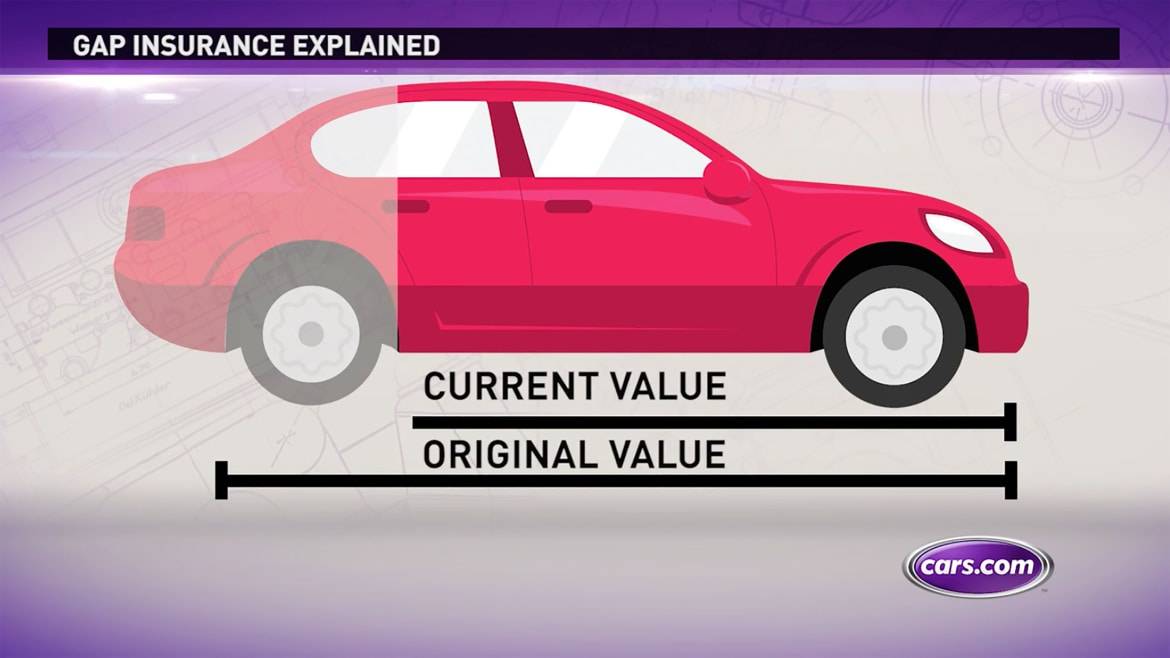

As it pertains to cars, gap insurance covers the difference between what you owe on your car loan and the actual cash value of your car if it’s totaled in a crash. That “gap” can amount to quite a bit of money, which you’d otherwise have to pay out of your own pocket — particularly if you didn’t put much money down when you bought the car (less than 20% or so) or took out a long-term loan (say, for more than five years). While the cost of gap insurance varies widely with the car, it can often be had in the $20-$60 per year range, and you typically only need it for the first few years. Here’s how to determine if you need gap insurance for your vehicle.

Related: What Is Gap Insurance?

Should I Get Gap Insurance?

If you owe more on your car than it’s worth, it’s called being “upside down” or “underwater.” This can happen very easily because a new car tends to depreciate quite a bit in its early years. Furthermore, if you took out a loan with interest, a disproportionate amount of your early monthly payments typically goes to paying off the total amount of interest owed over the length of the loan rather than paying off the principal on the car. (Toward the end of the loan, it reverses.)

For many people, gap insurance only makes sense for the first few years of ownership while they’re paying off a loan. Eventually, the amount you’ve paid toward the principal will have reduced the amount you still owe to less than the car’s value, eliminating the need for gap insurance.

For instance, if you took out a $20,000 loan on your car and paid off $12,000 in principal — leaving $8,000 to go — and the car is worth at least that same $8,000 if it’s totaled, you no longer need gap insurance. However, it’s important to remember to subtract the amount of your deductible from what the insurance company says is your car’s value, as that deductible could easily be $500-$1,500 or more. In the example above, if you have a $1,000 deductible and the value of your car is $8,000, you may want to keep your gap insurance until you have $7,000 left in principal.

The chip shortage has limited the number of new vehicles that can be built, which greatly increases the cost of new cars and the value of used ones. That’s good if you bought a car before prices went up, but if you bought a car after prices went up — and took out a loan for it — that could put you in a bad position when car prices drop back to normal. This would be a prime example of when it could be a good idea to get gap insurance.

Where Can I Get Gap Insurance?

While the dealer where you bought the car or the financial institution from which you got your loan would both like to sell you gap insurance, another option is getting it through your insurance company if it’s offered. For one thing, you may well be dealing with it already if your car is totaled. Also, you probably renew your insurance every 6-12 months, so it’s easier to be reminded to compare your car’s value to how much you owe on it to determine if you still need gap insurance.

How Do I Determine My Car’s Value?

Since your insurance company may be the entity determining how much you’d get paid if your car was totaled, it might be worthwhile to ask what source it uses to establish your car’s value.

Financial institution LendingTree.com suggests using industry standards such as Kelley Blue Book and NADAguides.com to determine fair market value. Note that the trade-in value on any of these sites will be lower than retail or private-party values, so check on which is used. Beware if Black Book is the source, however: It’s primarily for dealers, tends to quote lower figures and isn’t available online for free. Once you know how your car’s value is determined, you can check it online yourself.

More From Cars.com:

- How to Get a Car Loan

- How Much Car Insurance Do I Need? 5 Key Coverage Considerations

- More Car Insurance Coverage

- Find Your Next Car

- Are Certified Pre-Owned Cars Worth It?

Related Video:

Cars.com’s Editorial department is your source for automotive news and reviews. In line with Cars.com’s long-standing ethics policy, editors and reviewers don’t accept gifts or free trips from automakers. The Editorial department is independent of Cars.com’s advertising, sales and sponsored content departments.

Featured stories